As Featured In

Reinventing the Global Luxury Market

Discover the epitome of Value-for-Value Exchange. Our exclusive, closed-loop business model caters to HNWI's and the high-end Luxury Partners who serve them. If you are focused on efficiently & effectively moving Value, not Cash, this is the right place for you.

How Can We Help You?

Select the scenario below that applies to you to find out how we can help you achieve your objectives.

Are You An Individual Seeking To Sell A High-Value Asset?

- Your asset no longer fits with your lifestyle and/or your portfolio’s needs.

- You don’t need cash and have trouble obtaining full value for your asset.

- You need to access the widest pool of qualified HNWI buyers.

Are You A Company Seeking To Sell Assets, Goods Or Services?

- You are seeking to access the widest pool of qualified HNWI buyers.

- You want increased confidence and trust that sales will be realized.

- You are experiencing persistent friction in the sales process.

Are You Seeking To Acquire A Luxury Asset, Good Or Service?

- You want to move away from cash into high value tangible assets.

- You want to acquire the best services to fit with your lifestyle.

- You need confidence that your service provider is trustworthy.

Are You Seeking To Acquire IDON To Access Our Luxury Economy?

- Your cash reserves are losing value and you want tangible hard assets.

- You know high-end luxury assets is where you want to be.

- You desire to be ready for new opportunities in the Idoneus Economy.

(Already a member of our community? Go directly to the Portfolios.)

The Exceptional People We Serve

Our exceptional clients and partners are engaging in a borderless economy, where freedom of choice and control over wealth is the foundation.

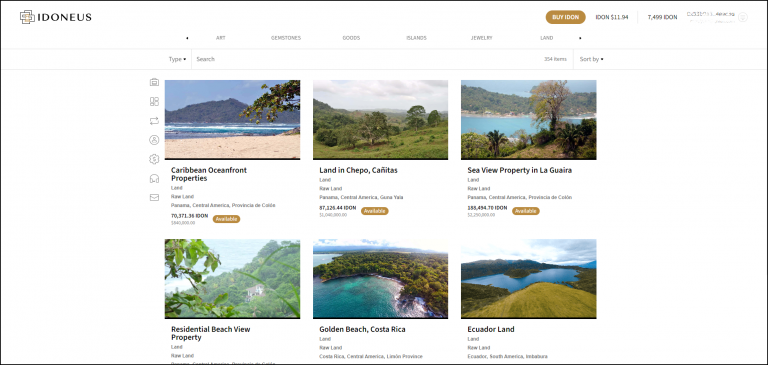

The Exceptional Assets, Goods & Services We Offer

Idoneus has been created by a team of industry-leading professionals with a long history of pioneering services in the luxury asset trading industry, representing over a century of experience and who have facilitated high-value asset exchanges and acquisitions on five continents.

The Idoneus Economy is underpinned by a token-based e-commerce / asset monetization platform, utilizing blockchain, smart contracts and state-of-the-art web & mobile application technology, to enable fast, secure, contact-free payment for luxury assets and experiences for beachfront villas, boutique hotels, luxury yachts, fine art, diamonds and much more.

The Idoneus Platform is a hybrid platform that is built for transactions as well as to provide innovative products & services to our users.

A Swiss payment token that enables access to the platform and opportunities, asset value offset and serves as the primary payment method in the Idoneus Economy. It is used to buy, sell, rent and otherwise experience luxury assets, goods and services.

All transactions on the Idoneus Platform are completed with IDON.

As a member of the self-regulatory organization Financial Services Standards Association (VQF), Idoneus is a financial intermediary and subject to Swiss regulations.

- KYC/AML/CFT compliant protocols are enforced.

- Access restricted to qualified and verified participants.

- Due diligence performed on assets, suppliers and partners.

- Adherence to comprehensive Swiss data privacy laws.

- Formalized confidentiality and privacy measures.

How We Deliver Exceptional Value

Idoneus brings the high-value asset trading business to the digital world to overcome the challenges of the analog model, as well as to take advantage of the opportunities that digital and blockchain / decentralized technologies unlock. Idoneus provides clients with unique access to the latest innovations, combined with stable infrastructure supported by a strong team of experts.

Experience

Years of high value asset trading.

Countries

Number of countries transacted in.

Transactions

Value exchanged using IDON.

IDON: Today's Preferred Currency for Luxury

Today’s economy is increasingly uncertain. Tomorrow’s economy is risk-managed, secure and contact-free. Idoneus’ closed-loop economy operates with a purpose-built crypto token, IDON. All transactions on the Idoneus Platform are completed with IDON. IDON is built on the Ethereum blockchain, and is managed through secure smart contracts.

Easily divest out of dormant, under-utilized, or under-performing holdings, and move into an asset class with no holding costs and growing utility.

Diversify your portfolio and keep transactions for luxury assets and experiences within the network, using IDON, avoiding external currency fluctuations and other sector-based shocks.

A digital currency that can be utilized to buy or rent physical assets, goods and services of nearly every kind, at fair market value.

Simply log on and transact. IDON enables fast, secure, contact-free payment for luxury assets and experiences, such as beachfront villas, fine jewelry, boutique hotels, luxury vehicles, private yachts, fine art and more.

Latest News & Announcements

Luxury Value Exchange Reinvented, Globally – Idoneus Announces Delivery of New Idoneus Platform with Enhanced Features and Functionality

Read More »Frequently Asked Questions

- The focus on the barter trade foundation: use an asset to buy an asset.

- The utilization of the IDON token that makes the barter trade model much more flexible.

- The application of blockchain technology to provide transparency, security, privacy and functionality.

- The unique closed-loop ecosystem that has been designed to be fair, transparent, and aligned with the platform’s goals and values, while also encouraging active participation and engagement from users.

Check out the Whitepaper to read more about the Idoneus closed-loop Economy for luxury.

There are several things that make IDON different from other cryptocurrencies, such as:

- The price of IDON is derived by a transparent, auditable algorithm. It is therefor protected from the crypto market volatility.

- IDON is not listed on any public crypto exchange and therefor not exposed to the various challenges of crypto exchanges.

- It is compliant with the comprehensive KYC/AML requirements of the Swiss financial regulatory bodies.

- No ICO, IEO or STO was ever executed to raise funds.

To protect the economy within Idoneus and to avoid inflation of the value of the IDON token, a series of rules have been established that are governed by a transparent and auditable pricing algorithm.

The operation of the IDON valuation algorithm requires that conditions of use and scale of transactions are met. It is based on quantitative, verified data regarding real-world movements of value in and out of the Idoneus Ecosystem.

- The first one is very simple, the token must be re-valued based on the value of transactions that are carried out. If, for example, a transaction has occurred, the value of the token will rise.

- A second mechanism has to do with the scalability of the market, the more goods and services and their value is onboarded to the platform in 100% convertibility to IDON, the more value the token will acquire. Conversely, if the amount of value integrated into the platform decreases, there must be a devaluation of the token.

- To protect the Idoneus ecosystem from volatility and the constant changes associated with external economic shocks, and exchange rates, the IDON will always have a minimum value of $10.00 (USD). This value is based on what is the long-term value of the tradeable luxury goods business on the platform.

For more detailed information, please visit the IDON Token page.

Yes, if you want to accept IDON as a means of payment for the luxury assets, goods or services that you offer, we would love to have a conversation with you. To onboard your inventory for 100% IDON to the Idoneus Platform utilizing the infrastructure that we provide, please submit some basic information about your inventory to get the onboarding process started.

Yes. Idoneus is compliant with the KYC/AML requirements of the Swiss financial regulatory bodies. As such, we require that users register an account and go through the necessary KYC protocols. At the same time Idoneus is also compliant with the strict Swiss data protection requirements which ensure that your personal data is safe.

The KYC/AML protocol is done in the simplest way possible, using sophisticated technology. Identity Verification with us takes not more than a couple of minutes.

Idoneus is located in Zug, Switzerland, home of the famed Crypto Valley. There are many reasons for choosing to be located in Switzerland, amongst them are:

- Well-established legal & regulatory framework for crypto / blockchain.

- Strict data protection regulations.

- Strict compliance, KYC / AML, etc regulations.

- Wealth management reputation.

- Strong business infrastructure.

- Central geographical location.

- Globally recognized for quality.

Do you have more questions? Please visit our Support Center.

Want To Know More?

We are here to help. Our team is available to answer your questions. To inquire, please send us a message and let us know the nature of your inquiry.